Before starting Artis Trade Invest, my experiences in trade were many and varied, giving me a wide view of the trade-financing industry. Trade takes place and can be facilitated locally or around the world; it is somehow a product without borders but not without human hurdles. We care to dispel the myth that trade investment is only for the generationally wealthy or a class reserved for banks to finance from an investor perspective. Trade finance is a competitive and safe investment category and should be part of any balanced investment portfolio.

From a fund manager’s perspective, investors should see trade finance as a profitable, secure asset class paying dividends predictably over the long term. Investment in trade is not speculative and has neither the ups nor downs of private equity, but rather the calm of a fixed-income type of investment.

In creating Artis, we feel to combat the rigid modern-day structure of bank loans, to bring this affordable and lucrative investment option to the shareholders and SMEs who have the most to gain. Trade finance underpins trade at every stage of the supply chain. Peer-to-peer lending through trade finance is a modern form of investing. Trade finance provides an opportunity for investors to harvest yields with low risk and low volatility.

At Artis, we are committed to trade arrangements that benefit businesses, grow the world economy and create revenues for our shareholders. We study the markets, financial history and economic trends, to make trade finance available for eager investors regardless of their experience or expertise. We don’t just move money around for stakeholders. We walk them through the process alongside project managers for an educational and transparent investing process.

Our contracts are thorough, written in line with local and international laws that pertain to each unique transaction. Though it sounds simple, structuring a trade-financing arrangement is a lengthy process.

We streamline the trading methodology and ensure that every trade works and satisfies all stakeholders’ needs, including the firm, the investors and the importers and exporters involved.

Next, we look at the layout of the Artis process for researching, structuring and assessing all trade deals, and how a company complies with the sanctions imposed.

Artis’ Due Diligence Process and Legal Mitigation Checklist

Validate the Local Buyer/Importer

The process commences with the buyer’s and seller’s basic legal and financial background checks. We investigate the payment habits of our clients. Are there late payments, bankruptcies or pop-up, fly-by-night trading subsidiaries? Do the parties have a good relationship with their current distributors? What do average annual sales look like?

How much product can they produce/ship/move and so forth? In other words, we carry out in-depth desktop research combined with feedback from our networks, where available. The results are submitted to our risk-assessment team. We take a holistic approach to the business of our partners where credit assessment is important but not the only criterion.

An increasing number of investors expect the business or corporation to be committed to responsible investment. This is often a key consideration before investing. For investors today – and regardless of the size of investment – the social and environmental attitude of the investment target is not just another important box to tick; for many it has become a must. Responsible investing is encouraged by global trade regulators.

KYC – the Know Your Customer Process, or Does the Fog in London Know More Than We Do?

In the late Sixties and into the Seventies, there was a series on German TV, Graf Yoster bittet um die Ehre (Graf Yoster asks for the honour) and one of the series was called: “Does the fog in London know more than we do”. It was a very similar series to the popular British Avengers, many have fond memories of it; there is a often a lot of fog surrounding KYC.

KYC serves as the guideline for preventing the abuse of the financial system with ‘foggy’ transactions, better known as AML − anti-money laundering.

In theory, KYC can be pushed to endless degrees, so ideally common sense should be applied. KYC and AML can present a genuine problem for companies trying to get legitimate payments completed promptly.

There seems to be no ceiling on what payment departments sometimes request in proof for payment. The latter can be a hindrance in today’s working environment, where employees in the financial industry fear for their jobs if they make even small mistakes.

The identity-verification piece of KYC helps to prevent fraud in banking and to ensure that customers are who they claim to be. The process allows institutions to audit their customers and prevent them from committing fraud, tax evasion, financing terrorism and from committing other financial crimes the papers often write about.

Regulators want you to know your customer and your customer’s customer’s customer, and so on. A company must of course gather information on its customers to correctly identify them, monitor their transactions and assess the overall risk factors to mitigate them.

The KYC check includes AML requirements and consequently a focus on the importer-exporter relationship. International trade, especially since the digitalisation quantum leap, might invite those that shun the law to move funds derived from foggy trades, betting on a low risk of detection.

Money laundering happens all day long in many places that still function with cash such as coffee shops, laundrettes and other retailers. Mediterranean countries still use much more cash than the Nordic countries.

The first rule that flushes out most transgressions is always to request to speak to the party who writes the cheque or makes the transfer. This eliminates most people in the middle and transactions that exist only on paper evaporate. AML covers the laws, regulations and procedures to shed light on the opaque. Technology has become a major driver for AML and KYC processes.

Absolute certainty is unrealistic. Those with ‘foggy’ intentions will not rely on standard payments systems to start with. Investigative journalism produced millions of documents in the ‘Panama Papers’ and the ‘Paradise Papers’ scandals, when millions of dollars’ worth of ‘dirty money’ was exposed. Thorough due diligence along with a dose of common sense still goes a long way.

Today, even small companies, let alone multinationals, tend to spend considerable resources to comply with ever-increasing and often changing regulations. Compliance departments are still growing at a remarkable speed. The cost of doing trade has increased.

Step 1: Validation – Key Actions

- Check the reputation of the key stakeholder, management, board and shareholders.

- Check involved names against the Specially Designated Nationals List (SDN) and sanction list.

- Check the ultimate beneficial owners (UBO) of the companies involved, identifying who is/are the shareholder(s) and are shareholders a corporation, possibly owned by another company?

When reviewing the banks involved on the buyer’s and seller’s side, check the following:

- Are these banks experienced in this type of transaction?

- Are there any sanction issues?

- Who are the shareholders of the bank, if it is not one of the known high-street names?

Product

For trade financiers, validating a product goes far beyond regular inspections and testing. Artis takes time to fully understand the product being created, bought and sold as each shipment financed belongs to the company once an agreement is approved.

Artis’ product inventory includes details of product(s) and components, where the manufactured items come from and where they are being sold to. We check whether supply-chain verification is possible and what collateral (LC, credit insurance or other) is in place.

To use an example, let us imagine that a flower shop in Zurich’s prestigious Bahnhofstrasse receives fresh flowers from Ecuador, a major producer of cut flowers.

Regardless of the day of the week or the season, when the client enters the shop, the flowers must smell and look as fresh as if they had just been picked a few hours ago. Anything else is a loss for the shop owner. Selling ‘end-of-the-day’ flowers with a steep discount or not at all marks a bad end to the day. This example reminds us how the precision of process and logistics can decide between a successful trade or a financial loss.

At Artis, we decided not to get involved with perishable goods. Dried fruits, nuts and dates are the limit for us – fresh flowers or perishable goods including frozen fish are not a risk we wish to take at this point.

Step 2: Product – Key Actions

- Undertake a product check and analysis of the industry at large. Are products free of any sanctions? If not, which sanctions might apply (mainly US, EU, UN?) Lately, China and Russia entered the worldwide sanction ‘competition’, sanctioning mainly Western companies and individuals. These new national sanctions registers must now be monitored as well.

- Is possible dual use checked? This is especially important for raw materials and semi-finished products. Dual-use goods are items that can be used both for civilian and military applications. These types of goods are heavily regulated because they can be classified for civilian use and then transformed for military purposes, or worse, used for terrorism.

- Are the products registered with a ministry (usually health or industry?) If so, who is the registrar and responsible for the product’s safe delivery in the country? If the products are not registered, is registration required? If so, has the process been initiated?

Validate the Counterparties; Seller/Buyer/Importer/ Exporter

We focus on jurisdictions where we can rely on a reputable and experienced team on the ground and develop reliable business relationships across sectors and industries with sellers and buyers.

At the moment, our factoring focus is on Switzerland. However, we are exploring other hubs that fit our requirements and where there are strong teams on the ground, in particular Brazil, Germany and Greece.

We prefer repeat business and ongoing relationships with suppliers or exporters where we validate the process and rely on sellers’ and buyers’ proper execution. We verify the importers’ market as well and its ability to sell the product. If the sale is unlikely, so is the repayment.

Once we validate the parties involved and the validity of the business concept, assessing the trade’s economic sustainability comes next.

Step 3: Validate Counterparties – Key Actions

- Check the seller’s experience and reputation in their market, including:

- Previous trade volumes

- Frequencies of trades and financial volume per transaction

- Other types of experiences or problems.

- Has the seller been affected by or has been subject to any US/ UN/EU sanctions in the past?

- Validate ownership of the seller, especially if the business is privately owned. Listed companies are easier to verify.

- How is the trade settled? (ex-works, free on board, cost and freight or upon discharge?)

- Check payment terms. How is the payment cleared, and through which party?

Transaction

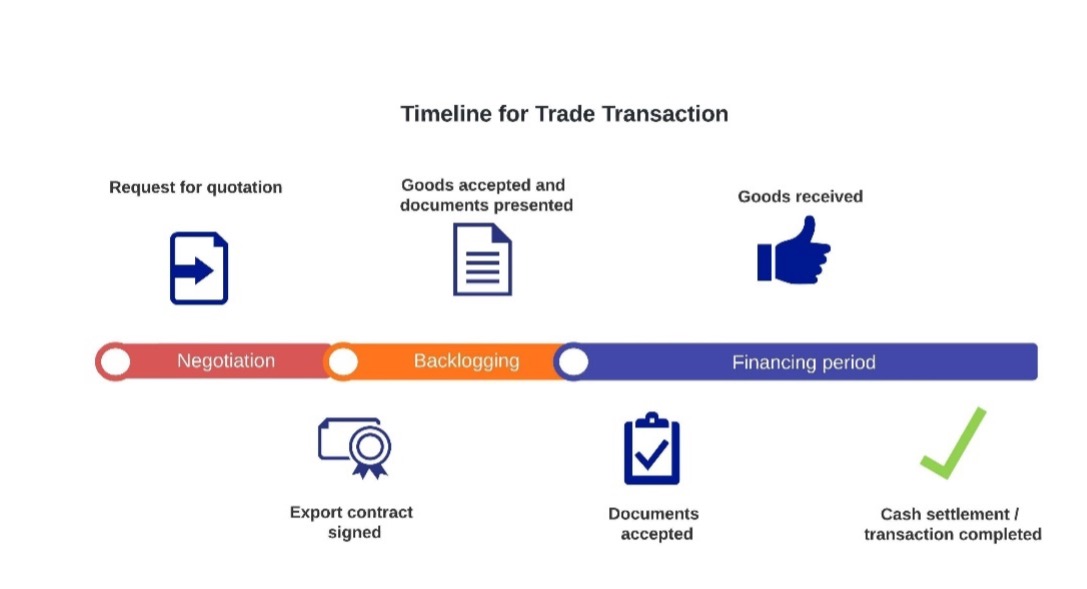

With the due diligence completed, it is time to structure the transaction to identify each party’s role in the trade’s financing. Risk mitigation remains key, and the structure of the trade should satisfy all parties.

Open account refers to where the goods are shipped and delivered before the payment is due. While this is great for the buyer/ importer, it can be a risk for the seller or exporter and can fall back on the financier in cases where the importer defaults or doesn’t honour the agreed payment terms.

Mobile or consumer goods cannot be recovered in case of non-payment as they have already been distributed. Open account trades are ideally credit insured. If a national export credit insurance policy does not cover the destination (some don’t cover Sudan for instance), personal or corporate guarantees might help.

Purchase and sale: here the financing party replaces the buyer and takes ownership of the asset financed. The financing party buys the export straight from the merchandiser selling it to the importer, including the financing margin. This helps SMEs who require more flexible terms than an exporter can provide.

Where SMEs applying for trade financing have higher financial risks, catalytic credit-enhancement tools, like first-loss capital may be suitable. First-loss capital is defined by three features.

First, the investment firm will bear or cover the initial loss. The amount of loss covered is agreed upon upfront. In line with the risk taken, this financing tranche receives the highest return; this is the point at which hedge funds and speculators often invest.

Then, with the initial loss covered, the recipient’s risk-return profile is improved, increasing the applicant’s desirability for potential investors. Portfolio investors like this risk level. The third point is that it is a highly specific tool for a designated purpose.

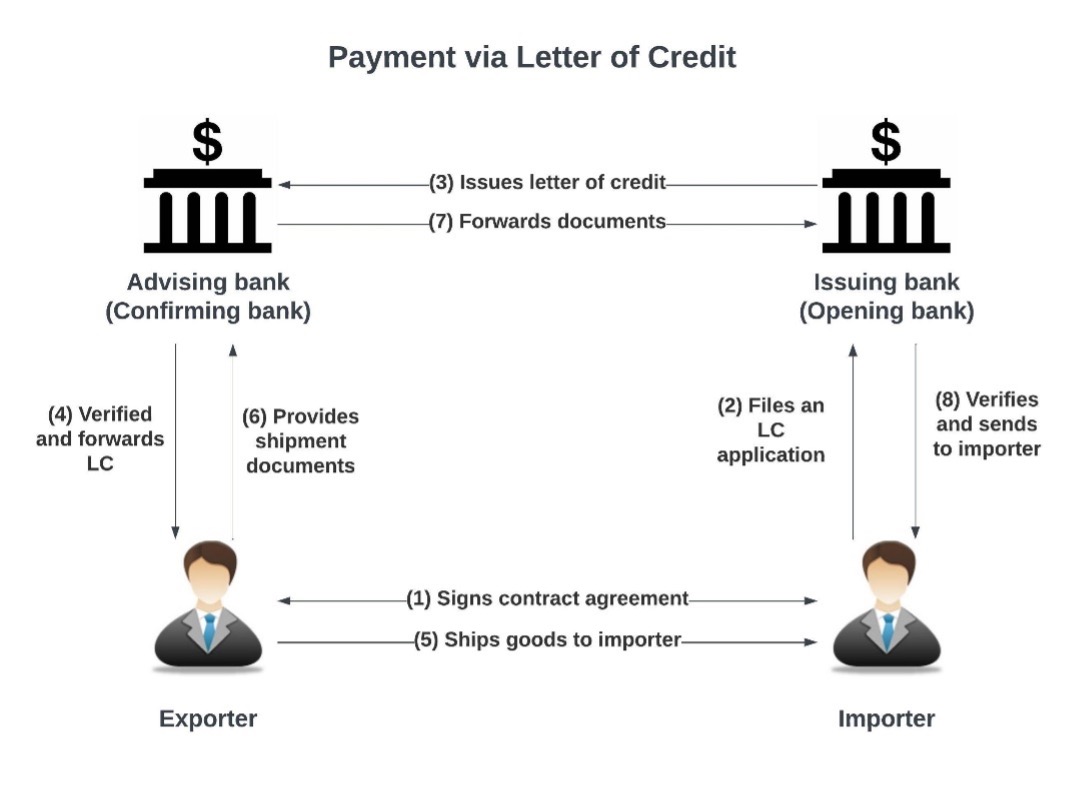

LCs (letters of credit) provide a secure way for the buyer and seller to safely trade with one another in any trade, nationally or internationally, even if the companies have never worked together before.

The buyer’s bank issues an LC, which is a legally binding promise to pay money to the exporter’s bank at a specific date in the future, provided an agreed product or service is exchanged on the agreed terms. It is the modern form of the banker’s acceptance discussed earlier.

An LC generally is irrevocable and conditional on certain documents being provided and dates being met. It acts as a document to back the trade and let parties work in confidence that their shipments/payments/ goods/services/ dates will be met.

Ensuring that the transaction is sound and profitable before it reaches this point is vital. Once the documents are signed and the transaction has been launched, exporters and importers get to work securing the materials necessary and preparing to open their doors to customers.

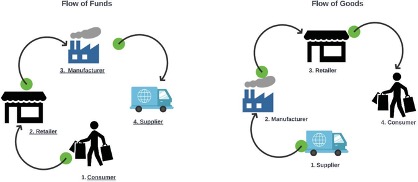

Step 4: Transaction – Key Actions

When identifying the parties involved in the trade agreement, there are a few things to check:

- Is a financial or operational intermediary involved, or is it a direct sale?

- Look at the Companies House details of seller and buyer, and details of intermediaries (if any) and create a diagram of the transactions, including the following:

- names of all parties (direct, indirect, remote)

- product flow(s)

- money flow(s) and

- contractual relationships. This all gives an immediate overview of the lie of the land and who is who in the transaction.

- Validate transaction design with an international exporter.

- Inform the importer.

- Are there any other issues, whether related or unrelated?

Risks Identified

We have now covered the major areas of trade-financing risk, including political risks, supply-chain risk and, of course, the risk of human error among others. As much as trade-finance firms might love to support all SMEs, these various avenues of risk are all potential deal killers with new clients, even more so when working with international trades.

Whenever we look at a prospective client, Artis checks for certain business markers to start to get a sense of the new client. Any lack of validated financial records and related information is an initial warning sign, and we might need to take a more holistic look at the business before moving forward with an agreement.

Companies that lack collateral pose yet another risk. If an SME is granted a financing agreement without putting forth collateral and ends up declaring bankruptcy or defaulting on its payments, the factoring company suffers the loss.

Depending on the transaction and the jurisdictions involved, collateral – personal or corporate – can be crucial for the outcome of an application; those who put forth substantial collateral are more likely to be approved for a financing agreement than the SME without it.

There is also the risk that KYC and AML laws will not catch all. The KYC and AML laws and fintech companies have made a significant contribution to keeping trade safe. We will cover KYC and AML more in chapter seven, where we take an in-depth look at the risks associated with trade and trade financing.

Step 5: Risks Identified – Key Actions

- Undertake thorough risk mitigation on a micro to macro scale.

- Investigate each stakeholder and party involved, from an operational, transactional and reputational perspective.

The Deal Process and Sanctions

Once the deal is deemed commercially viable, the companies involved have been researched and validated and risks have been assessed and mitigated, the next stage is to process the deal. A trade deal has many moving parts.

It is essential that the deal structure is sound and that the relevant legal mitigants are applied, ensuring that all paperwork is in order. The transaction must follow the many national sanction regulations.

As an example, in late 2021, the US increased trade sanctions on Venezuela, prohibiting US companies and passport holders from trading with the country as well as prohibiting transactions with Venezuela in US dollars. Petrochemical transactions, including crude oil, became a particular focus.

An Asian company, for argument’s sake, purchases agricultural goods from Venezuela or sells medical goods to Venezuela. The trade can be settled in either euros or Swiss francs. No sanctions of any kind are violated. The remaining problem is to find a bank willing to settle the trade, fearing for their banking relationship with the US, even though no sanction regime applies.

Sanctions are often a play of economic warfare thinly disguised in a legal framework but, in the end, create the desired effect, preventing the sanctioned country from trading. It is a given that sanctions are intended to deter business with the sanctioned country. So how should even a seasoned entrepreneur best navigate the choppy waters of commercial sanctions?

A good beginning is to ask if any of the involved parties regardless of their size or importance, figure on any national or supranational sanctions list (EU/US/UN /Russia and China), and if so, to what degree? With this validation a knowledgeable decision can be made, and an assessment made on whether a more in-depth KYC investigation is required. Involving resources like lawyers or investigation firms might be necessary to confirm the legality, often across various jurisdictions of the proposed transactions, or to start outlining the safe passage to transact in accordance with applicable sanction regulations.

In an ideal world, navigating international trade might be made easier if there were a single handbook with all the regulations one needs to know. Unfortunately, this does not exist. Each country or region, even cities (such as the Vatican) or international bodies (like the EU, UN, World Bank, IMF etc.) have their own different rules and regulations when it comes to trade.

These rules and regulations can come in the form of quotas, tariffs, non-tariff barriers, asset freeze/seizures or an embargo. Not all laws restrict trade outright, but every trade arrangement needs to meet the different thresholds depending on where the transaction is being executed, and who the importers and exporters are, as well as the state of international trade itself.

Quotas are government-imposed trade regulations that limit trade in some form. Sometimes the number of items shipped can be limited, or goods of a particular monetary value can’t be sent at any time; or the government will restrict how much can be sold in any given period, which would also be considered a quota.

An asset freeze means that any asset like land or property owned by an importer or exporter can be essentially frozen. As a result, the owned property can’t be moved or sold unless it’s done by or with the approval of the sanctioning nation. International laws remain vague about these matters. Both are tools used by governments to stop or limit trade with individuals, companies or economies.

Tariffs are mostly known as import taxes collected by the government. They fluctuate depending on the ever-changing political climate. Non-tariff barriers are restrictions on imported goods unrelated to taxes like specific licensing requirements or product standards. These are another tool for encouraging or discouraging trades of goods or services and financing arrangements. While tariffs don’t fully deter trade, they create costs and affect the overall financial result.

Finally, we have embargos. An embargo is the most limiting of all the legal sanctions, most commonly a complete ban on trade. This can be a ban on commercial activity in general, but sometimes it is just on the trade itself. Being up to date on embargos and where they exist is of the utmost importance for successfully navigating trade deals internationally.

We check each transaction, product and person against the current sanctions list. The process is cumbersome, extensive and unavoidable. It is the only safe way to operate within the safe-sanction ‘corridor’ and our clients appreciate having support from our in-house legal and risk team.

An offence against sanction laws is far from trivial and is considered a criminal offence by many jurisdictions, especially the US. A good criminal (not commercial) lawyer or barrister can offer valuable advice to SMEs who wish to engage with countries featuring on some countries’ sanction list and can be an excellent last source of guidance prior to signing a transaction.

Over all our years in the trade business, we have avoided legal problems. This is in no small part thanks to this lengthy due diligence, common sense and our dedicated and innovative team. Be stringent about whom you deal with. Make mistakes in the process and a whole deal can end up going sour, or an entire production line can be stopped short if a just-in-time product shipment is late. The last few years have demonstrated the supply issues being experienced around the globe.

Trade finance offers an abundance of opportunities. It is the job of Artis to navigate our partners through this economic ‘Bermuda Triangle’ safely. Good processes keep matters straight.

We manage reputational and payment worries for our clients. On the advisory side, we sell aspirin for trade ‘headaches’, so to speak. For example, in 2020 and 2021 we helped European companies who did not wish to send their team members to Kabul in person, with regard to their tenders with the Afghan government of that time. We act for companies in a variety of sectors, from paint and insurance to pharmaceuticals and tractors.

When Artis is not working as an agent for a client, then we are helping companies to finance their imports or open bank accounts. A bread-and-butter case is to facilitate acceptance of LCs or monetise credit lines through Trade REPO agreements. Quite a few SMEs find it difficult to get their LC confirmed.

As covered previously, LCs cannot be issued in non-convertible currencies. We often can accept local or non-confirmed LCs. With businesses in the UK, the EU, Switzerland, the Middle East and Central Asia, we provide the counterparty that suits the trade, in the correct currency and right jurisdiction.

In the face of new technology, we have digitised many of our processes for increased efficiency, shorter application processing times, early fraud detection (of LCs, mainly), and have streamlined our workflow. Fintech’s combination of blockchain and AI came as a blessing and has drastically changed the trade-financing landscape. It will continue to enable increased clarity, profitability and efficiency in the future of this trade sector.

Fintech and Blockchain in Trade

One of the most important features of blockchain is that it allows unrelated parties to carry out transactions and share data, simultaneously and transparently, on the same ledger. This technology allows all the individual pieces of a trade and the relevant paperwork to move and work synergistically instead of in a rigid sequence.

The old trade-financing system involved a lot of waiting for one action to be finished, then approved, and the entire process would stall until the right documents made it to the next person in the sequence.

Fintech is the integration of financial tools with the newest blockchain technology. This has been instrumental in pushing fintech forward in the trade-financing sector. The use of third-party evaluators to carry out transactions is now obsolete, and this further streamlines the process. Deploying blockchain makes the transactions encrypted and more secure in addition to providing transparency.

The future of trade financing is a much more streamlined process for due diligence and financing arrangements exclusively using fintech. Upon financing, the agreement of sale can be shared with the relevant bank using smart-contract features already integrated into blockchain technology.

This one step in the process converts an often two-week-long process to a one-step push of a button. In real time, the importer’s bank will have the capability to review the purchase agreement, draft the terms of credit and submit the obligation of payment paperwork to the exporter’s bank and relevant investment firms.

The export bank has the means to immediately review the obligation and provide payment once the arrangement is approved. The smart contract is automatically generated on the blockchain upon approval.

The exporter digitally signs the blockchain-equivalent of an LC. Upon their signature, the smart contract is initiated and the first shipment is automatically scheduled.

Once the paperwork is complete and the goods are ready to be shipped, they are inspected by a third-party customs agent who signs off on all the goods, again using blockchain technology. Instead of involving multiple moving documents, customs agents at the exporting and importing ports work off the same verifying documents. Upon delivery, the importer will review the goods, and if everything is provided as promised, they sign off on the delivery using blockchain, which automatically triggers the payment for the goods.

This new level of transparency extends to international regulators keeping an eye on trade. Regulators are provided with a real-time snapshot of essential documentation to enforce international regulations and capture fraud. Traders, financiers and regulators no longer need to sit on the phone or refresh their internet browser to know when a shipment will be delivered; it is automatically updated through the technology.

Removing the middle person and providing goods and services directly, also called disintermediation, is great for banks involved in LCs because the updated technology does not require them to assume any risk. The risk in the transaction would default to the investing firm, in this case, Artis or the supporting credit insurer. We have a risk-mitigation process firmly in practice.

Blockchain contracts reduce counterparty risk by showing investors bills of lading, the legal document issued by a carrier detailing all the information about the goods being shipped. A bill of lading signifies that a specific cargo or lot of goods has already been financed and is already allocated to a destination.

This aspect of fintech eliminates the possibility of double spending by a firm or double financing of a cargo shipment and supports the movement towards reducing fraud in the trade-finance industry.

By far the best feature is the automated settlement capability that reduces transaction fees. With the click of a button and digital signature after goods are received, payment is automatically processed to the exporter, reducing the amount of paperwork and eliminating unnecessary transaction fees.

Fintech has allowed Artis Trade the opportunity for continued expansion. The trade-finance opportunity is happening right here, right now.

Understanding the basics of how trade financing works is fundamental in understanding how you, as an investor, can benefit from financing trade. Some investors might prefer only to provide the funds needed to help facilitate a particular trade.

Others prefer getting involved more widely. While the levels of risk associated with each trade at the different levels of the chain are mostly the same, the amount of value that the product possesses as it goes through the chain changes.

This is referred to as the value chain, and it can be lucrative for investors to take advantage of this. We will later address the different parts of the value chain and what it means to invest at every level.