What are the reasons preventing banks from maximising their support to SME’s as the trade finance gap widens dramatically? We summarise a few facts about the trade finance gap evolution and explain why we see trade finance as one of the most attractive and underrated asset classes.

The trade finance gap – an investment opportunity

The exponential growth of the trade finance gap is, by any standards, an alarming situation. John Denton, the Secretary-General of the International Chamber of Commerce (ICC), voiced this in his letter to the FT of Sept 18th 2020, ahead of the G-20 summit. Other competent organisations, such as the Asian Development Bank, further document the threat.

What is the trade finance gap?

It is the difference between how much trade finance is requested and the actual trade finance provided by lending institutions. Every year, $1.5 to $1.6 trillion of trade finance demands are rejected, most of them in Asia. The World Economic Forum estimates a jump of the trade finance gap up to $2.5 trillion by 2025!

According to BIS, the Bank of International Settlements, more than 80% of today’s $10 trillion worldwide trade relies on trade finance. The Boston Consulting Group’s recent report suggests that this annual trade flow is expected to nearly triple, jumping to a staggering $27 trillion by 2027.

How did this gap develop, and what are the current challenges?

The term “trade finance gap” wasn’t in the headlines or prominent in the news until the world witnessed the financial crisis of 2008. The aftermath of the 2008 crisis brought with it an environment of new trade-related sanctions, regulations, strict lending policies, the rise of fintech and much more. As a result, financial institutions and banks started to reduce the lending options available to SMEs, thrusting the trade finance gap to centre stage.

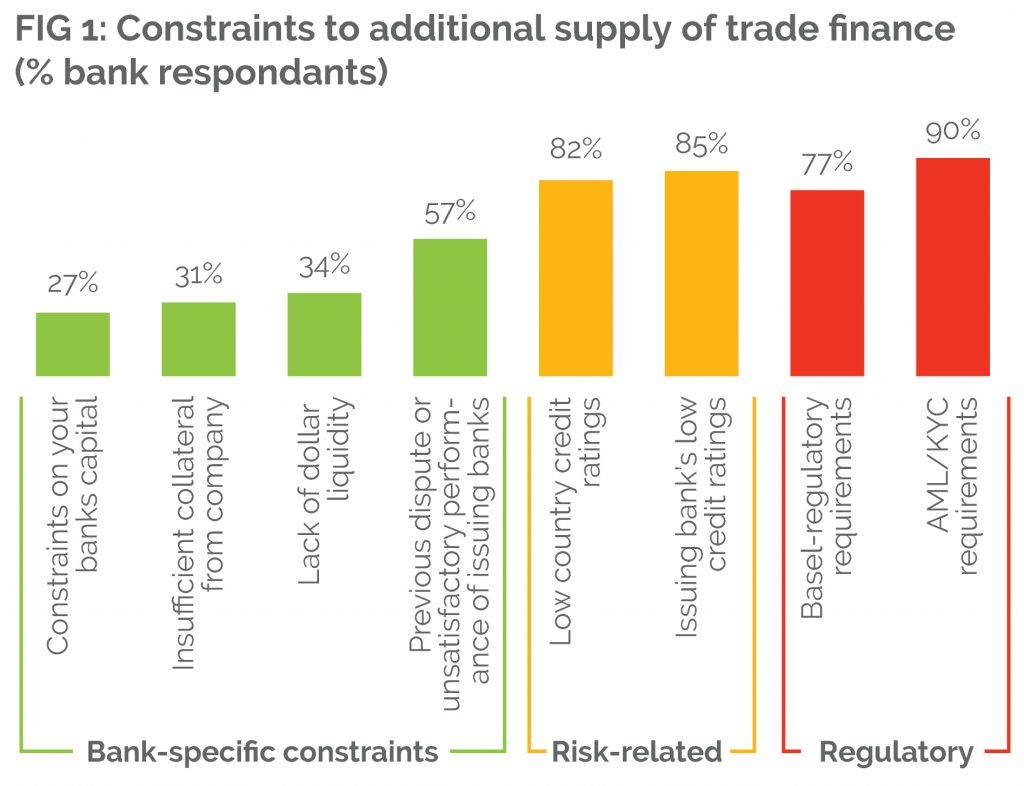

The trade finance gap is primarily affected by the following drivers:

- Risk and Profitability related to the counterparty bank itself

- Bank’s high interest in investing in various market segments, which seems to be a lower-risk business segment at a particular time

- Proper implementation/due diligence’s increased costs in trade-related transactions

These facts render it unlikely that the annual trade finance flow will reduce the trade finance gap in the coming years. The calculations underlying this statement do not consider any other financial crisis or impediments that may worsen the gap; the COVID-19 pandemic a prime example.

A high proportion of banks reject trade finance transactions due to KYC (know your customer) related concerns. Banks and financial institutions must meet their KYC guidelines, requiring them to identify the client’s identity, suitability and risks involved. Additionally, in financial crises (such as the COVID-19 pandemic), additional barriers like trade sanctions, closed borders, tariff, and non-tariff barriers come into place.

Ever since the term ‘trade finance gap’ was first coined, the trade finance rejection rate for SME’s has remained above 50%, and it’s only rising with time. The main culprit is the tightening of regulations. With it, the related cost of the transaction now suffocates the trade.

What has been the impact of COVID-19 on trade finance?

Frictionless trade is essential to save lives. During a crisis, food, medical supplies, and equipment must be delivered unhindered. The pandemic highlighted how vulnerable our supply chains and connections are. Recent food and medical supply shortages were proof of this.

COVID-19 worsened the already present drivers of the trade finance gap. The lack of trade financing available continues to hamper the recovery of the economies around the world. Although organisations worldwide have started taking measures to slow down the widening of the trade gap, according to the ICC, a possible $5 trillion is needed to enable rapid recovery from COVID-19 and help small businesses survive.

OECD countries, alongside their Export Credit Agencies, have taken multiple measures to tackle the situation. These measures have primarily been used to secure existing transactions and support specific industries that have been hit hardest by the pandemic, such as the travel and hospitality sectors.

Investing in trade finance creates a fertile foundation for global trade to recover. A recovering economy is critical now and will benefit consumers, traders, financial institutions, and investors alike. In the current environment, when various organisations, including the World Trade Organisation (WTO), are lobbying governments to support SME’s to help facilitate quick recovery from COVID-19, maximising trade finance facilities to small and medium-size enterprise’s is critical.

With innovative tools and resources, private entities and non-banking financial institutes are best equipped to support this growing demand and help investors mitigate the risk and generate stable returns. Unlike the banking sector, these entities are less bound by stringent banking regulations or additional trade complexities. Their services are accessible to a broader range of global businesses, including SME’s.

Why is trade finance an interesting opportunity for investors today?

With the impact of COVID-19 and the increasing trade finance gap, banks have become increasingly reluctant to fulfil demand. This provides a unique opportunity for the alternative finance sector to invest in an attractive asset class called: trade receivables. Discounting receivable, also called factoring, is a beautiful fixed income-like asset class with low default rates, low volatility, and stable returns.

As of today, and even with the Greensill case fresh in peoples memories, trade finance has never sparked a financial crisis. But trade finance supply has always been affected by any financial market turmoil. The re-growth in supply contributes to a healthier economy. The trade sector, especially SME’s, are an integral part of the UN’s sustainable development goals. Investments made into this particular asset class of factoring benefits investors significantly, even during the recent disruption of COVID-19, and has a lasting impact by helping the world recover from the pandemic.

What is the historical performance of trade finance?

According to the 2019 ICC report, global trade finance transactions have low default rates below 1% and corporate lending is statistically riskier than trade finance lending.

With a surge of intangible asset valuations, investors are becoming increasingly aware of this asset class’ benefits, particularly if the invoice discounting is combined with credit insurance.

Trade finance is self-liquidating, recession-proof, and uncorrelated to the central bank’s interest rates policy. According to Eurekahedge, a research firm, the trade finance sector has proven to be resilient to geopolitical turbulence, much less likely with other asset classes.

In short: Trade finance is considered one of the safest asset classes to invest in, even during geopolitical or macroeconomic-related turbulence.