Part of our routine is to unravel opacities like what the Afghan nation is currently experiencing. Not long ago, new rulers took over all levels of politics, government, and society. Our job is about analysing financial issues of all sizes and subjects for the benefit of our clients’ businesses and the enhancement of our proprietary investments in the region.

The following summary is crafted to closely examine and describe the current commercial environment, financial opportunities, and obstacles in Afghanistan. This report should be neither read nor interpreted as opinions of the writers on political, strategic, or religious issues of Afghanistan or countries named herewith.

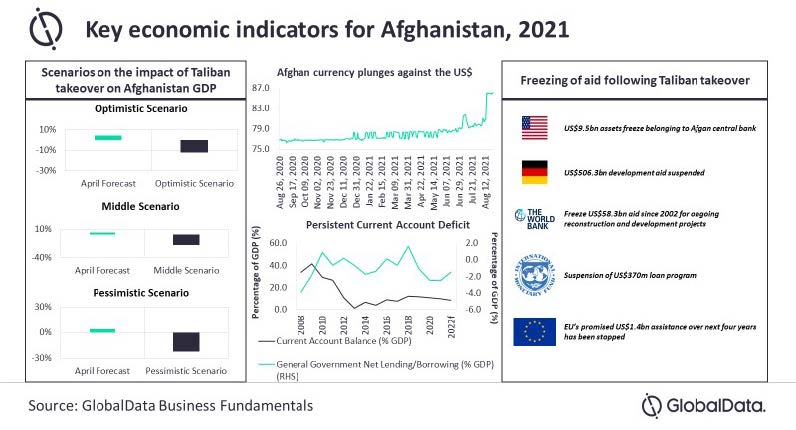

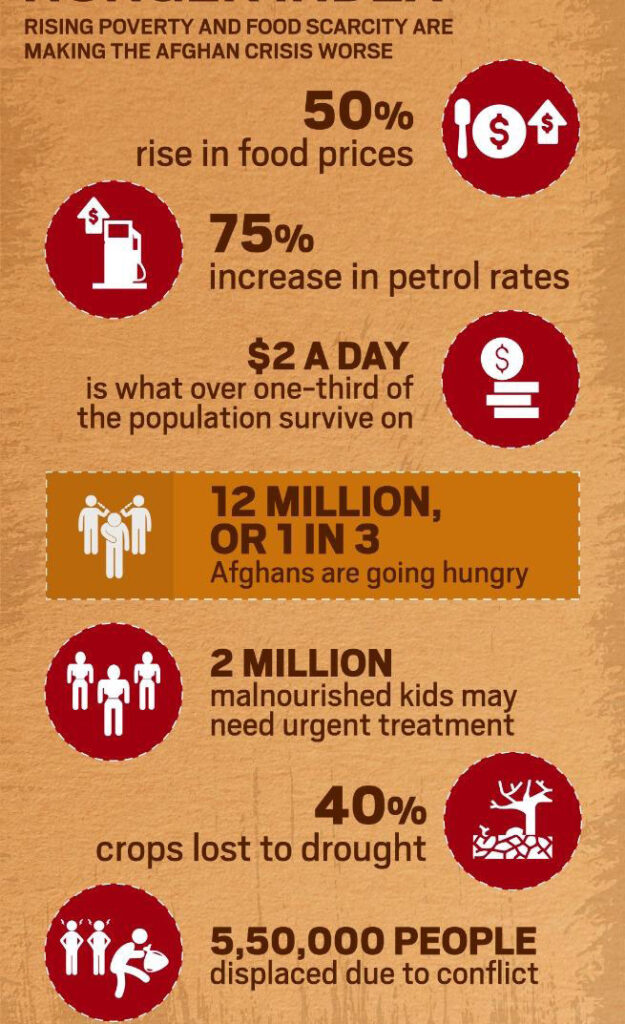

The worsening of Afghanistan’s steadily declining economy is everywhere in the headlines after the Taliban took control of the country’s affairs in mid-summer of 2021.

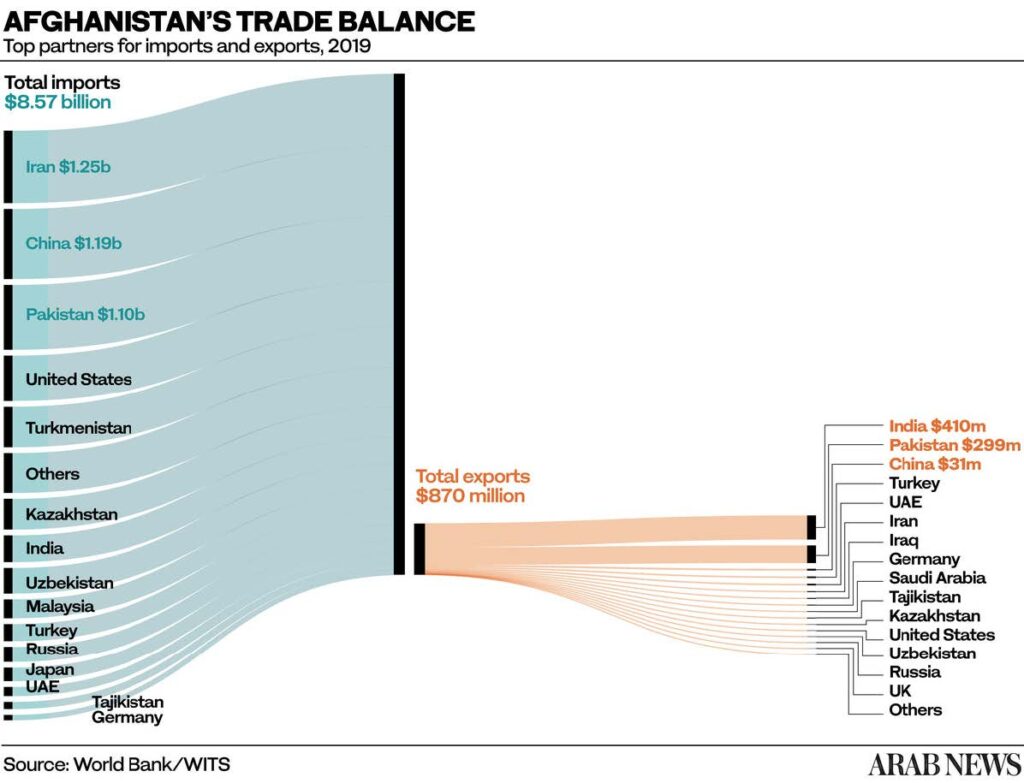

Afghanistan was already heavily affected by insecurity, corruption, drought, and government mismanagement, resulting in declining revenues. The Afghan economy is now facing further challenges after the Taliban takeover and the international community’s withdrawal of aid and assistance.

It will be primarily the actions of the newly formed Government of Afghanistan that will decide the fate of the economy of Afghanistan going forward and, most importantly, the international community’s winners and losers in this scenario.